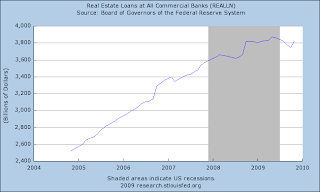

Here are the most recent numbers (in Billions)

2009-10-21 - - - 1949.799

2009-11-04 - - - 2024.393

2009-11-18 - - - 2012.162

2009-12-02 - - - 2093.677

Notice that the most recent number is $80 billion of new money in the system - in two weeks. It used to take a whole year to add that much in reserves.

These are huge numbers and ensure expansion and inflation unless something is done.

Here's the graph. (Click on the graph for a larger version)

This money is now sitting in bank vaults as excess reserves, waiting for bankers to decide who is credit worthy.

As loans pick up, the Fed will begin to withdraw this money from the system, but that time is a long way off.