The longer the yield spread remains above 300 basis points, the stronger will be the coming expansion.

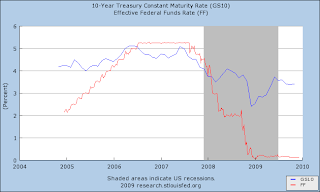

Here is the recent chart.

History suggests the yield spread will stay low for another year or more.

In the chart below we see that the yield spread must remain above 300 basis points for long periods to ensure economic growth.

Other Leading Indicators

The Conference Board's Index of Leading Indicators has been positive since March of 2009.

Coincident Indicators are making a bottom and will be turning positive in the next few months as Fed stimulus takes hold.

See Conference Board