- Correction in the stock market is over.

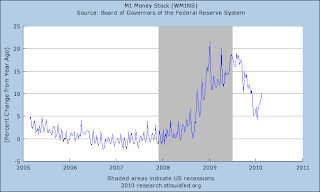

- Money supply still not growing

- Inflation begins

- Interest rates not rising

- Bank lending still falling

- GDP soars

- Business cycle growth continues

- Stock market in orderly move higher

- Government stimulus continues

- Dollar mixed

The following three graphs tell the story. M2 and MZM are still slowing. Only M1 is growing, and that is probably due to increases in the Base. Banks are not lending.

Monetary base continues to grow.

Inflation

The first signs of inflation came with the PPI for December with an increase of 1.4% for the month.The CRB trend has resumed its upward path.

GDP Soars

Economic growth continued this past quarter at increased at an annual rate of 5.9 percent in the fourth quarter of 2009 . In the third quarter, real GDP increased 2.2 percent.Price deflators are still benign.

Leading Economic Indicators signaled continued growth last week.

Stock Market

The stock market punched through resistance and made new highs for the move, heading for a resumption of the uptrend.

European investors poured money into US equities again this week, abandoning their own stock markets in favor of American investments.

Money market arbitrage gets harder and harder as spreads collapse and competition increases. To achieve even a 100 basis point spread between liabilities and assets requires taking on credit risk. The money market desk will earn its pay in the coming months.

Strategy

So far, the strategy of shortening asset maturities and lengthening liabilities has worked nicely. Keep doing it.

Tell the board it's time to find some credit worthy borrowers.

Make sure hedging operations are in place. Give the long bond desk a small position and encourage day trading: buying at support and selling at resistance. Get ready for the big short. It's coming.