Time to buy again? Prices are at support. Time to sell if support breaks?

The answer to the first question is no more buying long term assets.

The answer to the second question is yes, sell if bonds break major support.

Money Market Arbitrage is the tactic of choice.

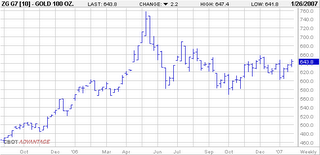

First, we look at the gold market.

GOLD FUTURES PRICES

Notice gold spiked back in June of 2006 and has stabilized at the $620 level and shows no sign of breaking out of this range.

Next, examine the money supply,

MONEY SUPPLY - MZM

Here we have troubling information. The money supply is still growing at an accelerating rate.

These numbers signal to both bonds and gold inflation is still a risk.

For this reason alone, it is prudent to keep an eye on the details of money growth.

What has the Fed been doing with the Monetary Base?

ST. LOUIS ADJUSTED MONETARY BASE

Base growth is declining, showing Fed restraint.

What have commercial banks been doing?

COMMERCIAL AND INDUSTRIAL LOANS

Here's the answer. Demand for credit is still running at 10% per year - even with Fed Funds at 5.25%!

This is a strong economy, with strond demands for credit, leading to strong growth in money.

If money growth is not met by equally strong growth in economic activity, inflation results.

How is the economy growing?

GDP - YEAR OVER YEAR CHANGES

The economy is growing nicely at the 6% level - year over year. No cause for alarm here. If money growth is 5% and economic growth is in the 6% range, there is no cause for alarm.

Is there reason for prudence? Or, should lenders and investors take this as another buying opportunity?

The alternatives are either long bonds or Fed Funds at 5.25%.

This chart looks at 30 year bonds for the recent past.

30 YEAR US TREASURY SECURITIES

Bond yields are still in the 5% range, but Fed Funds are higher.

Until the Fed decides to cut short-term rates, or until loan demand starts to slow, the prudent thing for an investor is to put extra cash to work in Money Market Arbitrage.