This is the week that helps predict the future for long-term interest rates.

The auction by the US Treasury of 10-year notes today, and 30-year bonds tomorrow provides the first data point in the new Fed-less bond market regime.

At the close of business yesterday, April 6, their respective yields were 3.98 and 4.84.

We will certainly revisit this data often in the months and years to come. Make a note.

The bond futures contract closed yesterday at 114.11. Make another note.

As the US Treasury sells more and more debt to refinance existing debt, and create new obligations to fund the expansion of government programs, rates are certain to rise.

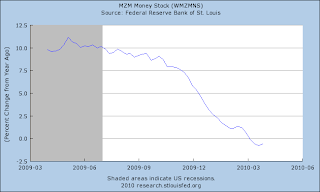

Combined with the Treasury's added supply, the US Federal Reserve will be selling both mortgage-backed securities and treasuries to reduce the amount of inflationary fuel in the banking system before the banks can use it to make loans to credit-worthy borrowers.

As banks make loans, and the economic expansion takes hold, inflation grows. Further pressure on bond holders will come from the deteriorating value of the currency. Inflation kills bonds.

The combined pressure from these three sources will be too great for bond yields to hold, and they will certainly continue the rise that began more than a year ago, when 30-year bond yields bottomed at 2.58 in late December of 2008.

Our trader is shorting bonds at every resistance level, and will soon be aggressively selling when support breaks - like today and tomorrow.

Paterson's analysis suggests that the bond contract has a long way to fall, and will probably break par, with yields above 6%.

Get short and get rich.

* * * * * J B K * * * * *

San Francisco

James B. Klein

Paterson Financial Services

WEBSITE: paterson.com

WEBLOG: paterson-financial-services.blogspot.com

NEWS WEBLOG: paterson-financial-services-news.blogspot.com